![[Podcast] Highly-qualified Human Resources for Sustainable Development in the Southeast Region (Part 1): The Current Situation regarding Regional Human Resources](/images/upload/img_background/ueh-bg-104518-052223.png)

[Podcast] Highly-qualified Human Resources for Sustainable Development in the Southeast Region (Part 1): The Current Situation regarding Regional Human Resources

Human resources are considered as one of the most important resources of the country, playing the decisive role in the growth and the development of the economy. With the purpose of developing the Southeast region in accordance with the planning of Resolution 24/NQ-TW, human resources, especially high-quality human resources associated with the region’s competitive advantages, need to be planned. Based on statistics and analysis, the author team from University of Economics Ho Chi Minh City (UEH) has clarified the shortage of human resources towards proposing some orientations on developing high-quality human resources to meet the requirements of sustainable development for the Southeast Region.

The first part of the article is to find out the advantageous industries and the current situation of high-quality human resources of the whole country and the current Southeast Region.

Industrial clusters in the Southeast Region occupying advantages

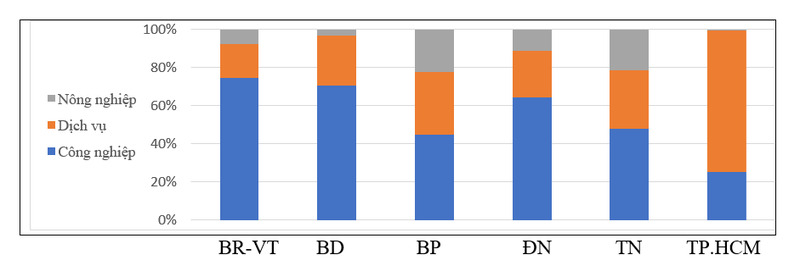

The economic structure of localities in the Southeast Region mainly focuses on industry - service. Figure 1 shows that industry is the mainstay in all localities, excluding Ho Chi Minh City, with its contribution to GRDP from the lowest 43.19% (Binh Phuoc) to the highest 68.74% (Ba Ria - Vung Tau). In Ho Chi Minh City alone, service surpassed industry, contributing to 64% of GRDP, in which trade was the leading group, followed by finance, banking and insurance with a ratio of 16.4% and 10.1% of GRDP, respectively.

Figure 1. Economic structure in localities in the Southeast Region. Source: Summary report on the implementation of Resolution No. 53/NQ-TW of Ba Ria - Vung Tau Province; Report on socio-economic, defense - security situation in 2022 of Binh Duong Province; Report on the implementation of the plan for socio-economic development and national defense of Dong Nai Province; Report on the implementation of the socio-economic development plan in 2022 and the socio-economic development plan in 2023 of Tay Ninh Province; Report on socio-economic situation in the fourth quarter of 2022 of Ho Chi Minh City

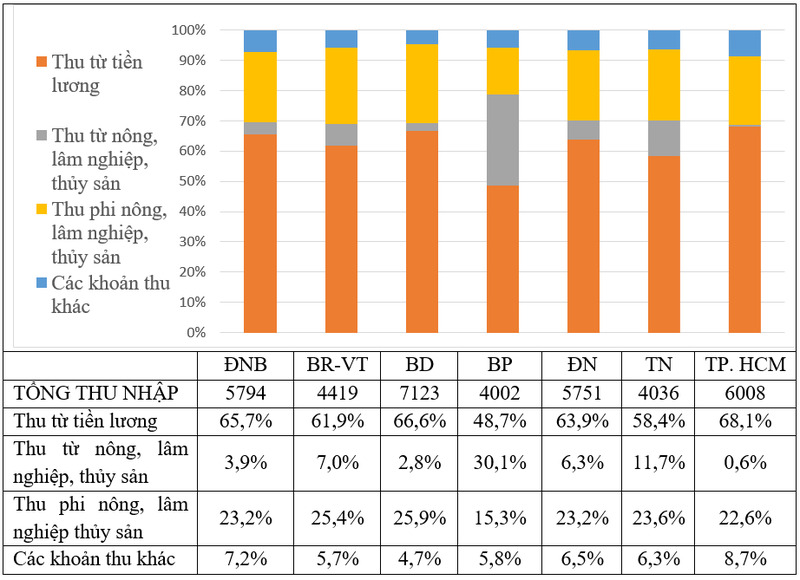

The industry-service-oriented economic structure has contributed to improving workers’ incomes. In terms of income structure, Binh Duong ranks first in the Southeast Region, followed by Ho Chi Minh City. These are two localities with high contribution rates of industry (Binh Duong) and services (Ho Chi Minh City) to the region’s GRDP. Meanwhile, the income source of Binh Phuoc and Tay Ninh has a relatively high contribution from agriculture, forestry and fishery although there is a tendency to increase the volume of industrial production (Figure 2). Statistics also indicates that Binh Phuoc with advantages in agricultural production is increasing labor productivity in agriculture, specific as follows: the proportion of the agricultural economy is 21.46% while the income from agriculture is 30.1%.

Figure 2. Percentage of monthly income per capita in 2021 at current prices by revenue source and by location. Source: General Statistics Office (2021)

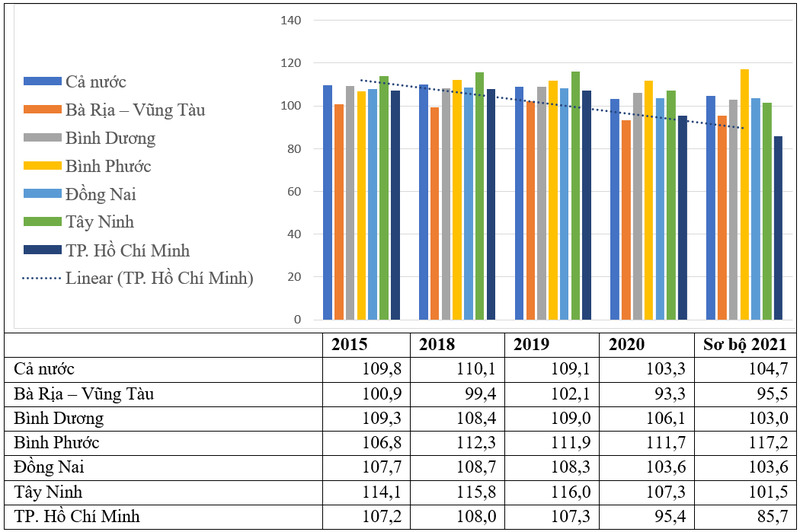

The development situation of localities in terms of industries is not identical. In general, the industrial product volume index tends to decrease. This is clearly shown in the statistics in the last 5 years (including the Covid situation) of Ba Ria-Vung Tau, Binh Duong and Ho Chi Minh City whereas Binh Phuoc, Dong Nai and Tay Ninh witness an increase in industrial production volume (Figure 3). On the basis of reality, localities plan to focus on clusters of industries in which they have competitive advantages, based on the exploitation of digital technology. Innovating the growth model in association with economic restructuring towards modernity, taking the digital economy, sharing economy, green economy, and circular economy as the focus and driving force for development.

Figure 3. Industrial production index by regions. Source: Statistical Yearbook (2021).

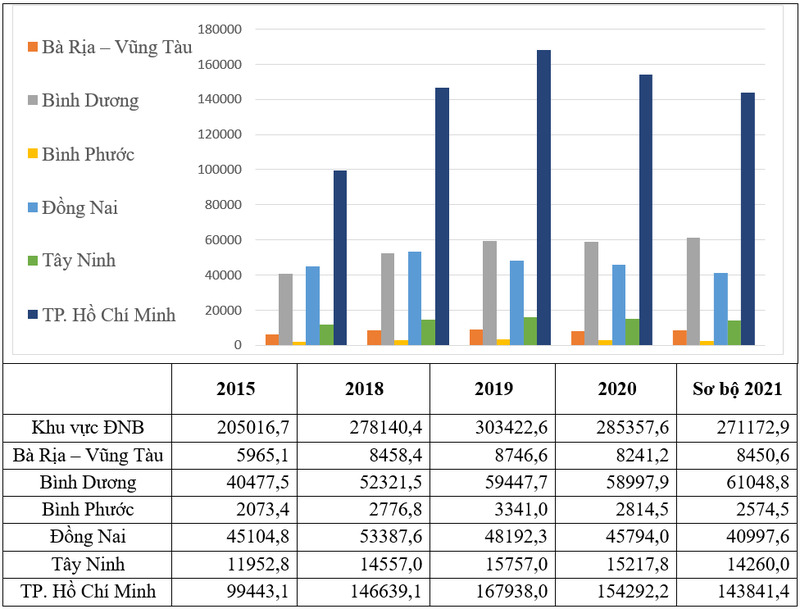

Transportation as the service industry develops in parallel with the economic growth. Therefore, the data over time have indicated the sustainable increase in the volume of domestic transport of all localities in the Southeast Region. In which, Ho Chi Minh City, Binh Duong, and Dong Nai are among the top localities in this activity (Figure 4). Based on the advantages of natural location, Ba Ria - Vung Tau orients for service development in the direction associated with sea advantages and diversity in tourism products, shipping and logistics. Logistics and supply chain management, one of the useful tools to help businesses link different stages within or among businesses, has been being applied in various economic sectors and any business classification. Therefore, logistics is an important component in the economic development of Ba Ria-Vung Tau in particular and of the region in general.

Figure 4. Volume of goods transported by localities (Thousand tons). Source: Statistical Yearbook (2021)

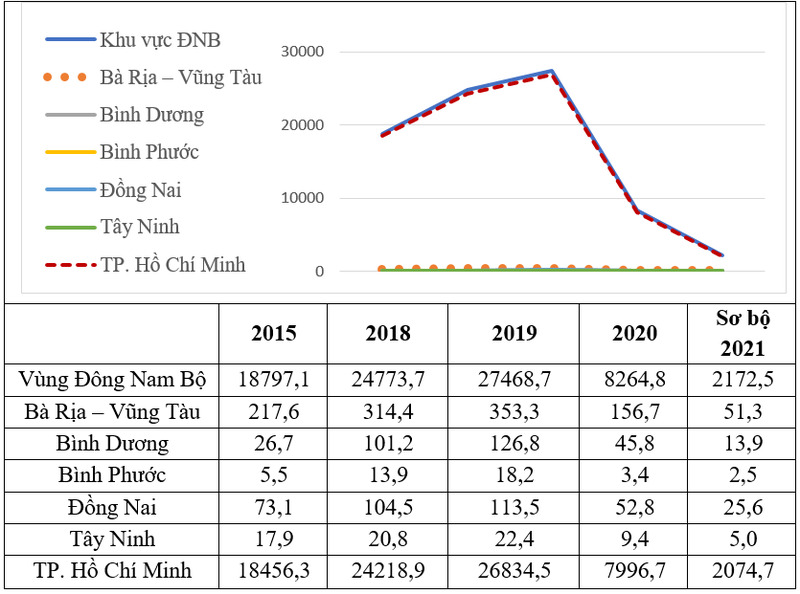

In terms of tourism industry, the data in Figure 5 demonstrate that only Ho Chi Minh City is the locomotive of tourism development, in which, the revenue from this activity is approximately equal to that of the entire Southeast Region. With its geographical position as the traffic hub of the country, including road, railway, waterway and air, Ho Chi Minh City has a favorable position in exchanging with localities, especially are localities in the Region thanks to the common administrative boundary with the following Provinces: Tay Ninh, Binh Duong, Dong Nai, and Ba Ria-Vung Tau. In fact, the source of tourists to the Southeast region mainly depends on the number of visitors to Ho Chi Minh City. This implies that the development of tourism in the Southeast requires cooperation and association to maximize the inherent potentials between localities in the region in the direction of clusters of industries to create common products and link links to create common products, creating a unique attraction of the Southeast region. Highly-qualified human resources and regional planning management play a crucial role in implementing this goal.

Figure 5. Travel and tourism revenue (VND billion). Source: Statistical Yearbook (2021)

The analysis regarding the development data of localities in the Southeast Region in the past 5 years affirms that there has been a shift in economic structure, focusing on services and industry. In terms of service, Ho Chi Minh City, Binh Duong, Dong Nai and Ba Ria - Vung Tau are the localities leading the development, typically in the transport, logistics and tourism industries. Dong Nai maintains its industrial strength while Binh Phuoc and Tay Ninh have advantages in agriculture and tend to shift strongly to industry. The identification of advantageous clusters of localities in the Region is the foundation for human resource development, realizing the goals of Resolution 24-NQ/TW for this Region.

The current situation of highly-qualified human resources of the whole country and of the Southeast Region

* In terms of quantity

Statistics by the General Statistics Office up to 2022 points out that the average population of the whole country is estimated at 98,506 million people, including an urban population of 36,564 million people, accounting for 37.12%; the rural population of 61,941 million people, accounting for 62.88%; the male population of 49,097 million accounting for 49.84% whereas female population of 49,409 million accounting for 50.16%.

Over the past 5 years, Vietnam’s population has increased by approximately 4.47% from 94.286 million people in 2017 to 98,506 million people in 2021. The annual population growth rate has been maintained between 0.95%-1.17%, with a downward trend in 2021, in which, the population growth favors the ratio of men to women.

The natural population growth rate of 9.3 %o/year in 2021 with a declining trend indicates the challenge for Vietnam once this population begins to move away from the golden population area, towards the senior aging population.

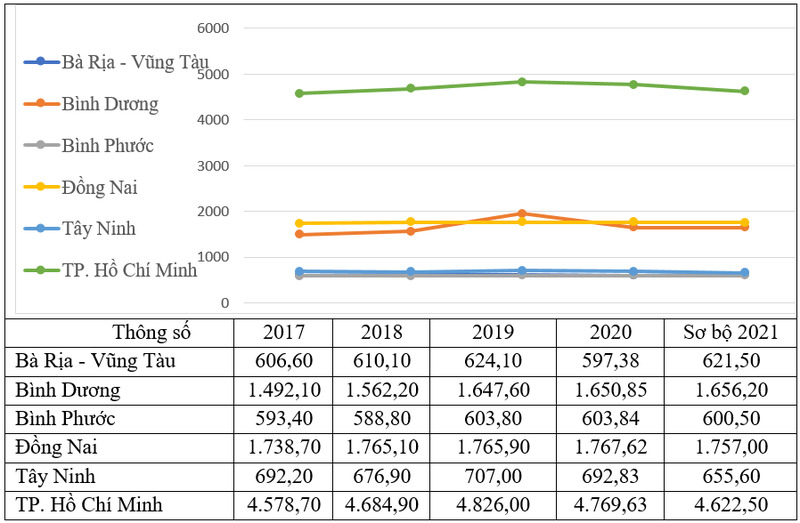

The Southeast Region is not an exception compared to the whole country and other regions. The labor force aged 15 and over increased slightly in the period 2017-2019, then gradually decreased in 2020 and 2021.

What is more special, the natural population growth rate of the Southeast Region is in the low group, only higher than that of the Mekong River Delta and North Central Coast and Central Coast. Meanwhile, the life expectancy remained stable in the increasing orientation. The challenge of aging population in terms of the labor force is inevitable as the natural population growth rate tends to decrease in the recent years.

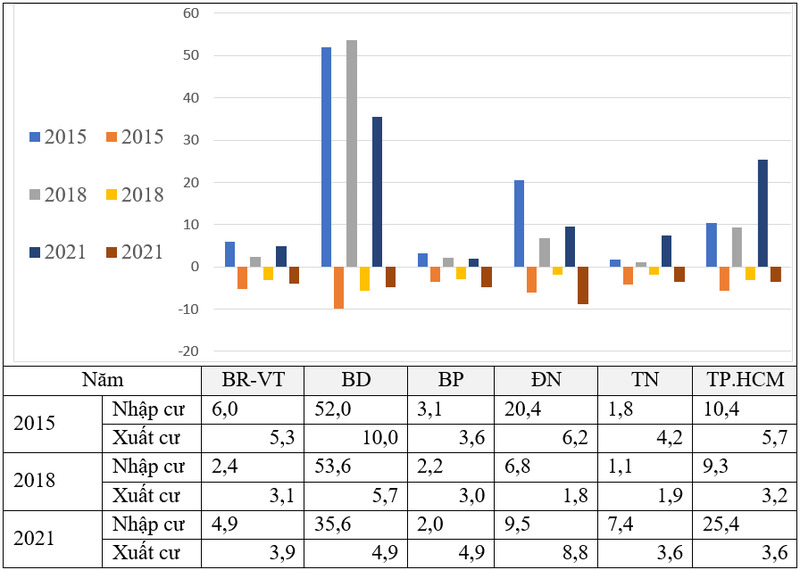

Concurrently, the internal migration tends to increase with the purpose of partially compensating for the shortage of labor force in localities due to the decrease in natural population growth rate. Figure 6 affirms that this region has a high immigration rate, especially in the Provinces with various industrial zones listed as Binh Duong, Dong Nai, and Ho Chi Minh City.

Figure 6. In-migration/out-migration rates in the Provinces of the Southeast Region. Source: Personal compilation from the data of the General Statistics Office (2022)

In terms of the labor force aged 15 and over, the statistics within 5 years, starting from 2017, presented that the labor force in the Southeast region had a slight increase until before 2019 and decreased two years later, 2020 and 2021. These two years are the period when the whole country was affected by the Covid-19 pandemic. As analyzed above, this area has quite a large population fluctuation which is caused by the high rate of in-migration/out-migration (Figure 7).

Figure 7. Labor force aged 15 years and over in the Provinces of the Southeast Region within the 2017-2021 period. Source: Personal compilation from data of the General Statistics Office (2022)

In addition to the declining trend in the labor force, the shift of labor between occupations took place strongly. The workforce in the industry and construction sectors will witness an increase in 2021. Similarly, the workforce of the service industry will face one decent growth. In addition, the labor structure has mainly shifted to the following industries: processing and manufacturing industries; building; warehouse transportation; accommodation and catering services; financial services, banking and insurance.

* In terms of quality

Firstly, the most outstanding feature of our country is that the number of trained workers has been being rather limited. The statistics states that the number of trained workers has increased slightly over the years. The proportion of trained workers in the Southeast region, which is rather high compared to that of the whole country (ranked second), tends to increase over time but revealed signs of slight decrease in 2021.

Secondly, the domestic labor market faces the challenge of a shortage of high-quality human resources. Although the structure of professional qualifications has increased in terms of graduates from the university and above, from 9.5% in 2017 to 11.67% in 2021, this rate is rather modest. Besides, the college group had a slight increase over time while the intermediate (vocational) group decreased. This implies the challenge for the lack of ‘worker’. In general, the labor demand for high-level technical expertise increases over time while the labor demand for simple occupations decreases. Therefore, there is a shift in labor towards reducing unskilled labor and increasing skilled labor.

Thirdly, labor productivity factor needs attention because this is a decisive factor in ensuring positive utilization of labor resources for economic growth. For nearly three decades, Vietnam’s labor productivity, despite some increase, has been rather slow. Vietnam’s labor productivity is just above the group of low-income countries and only within the threshold of 50% of the group of low-middle-income countries. From 2017 to 2022, Vietnam’s labor productivity is twice as high as that of the average labor productivity of low-income countries, equal to more than 50% of the group of low-middle-income countries and equal to 18.3% of the group of high-average-income countries.

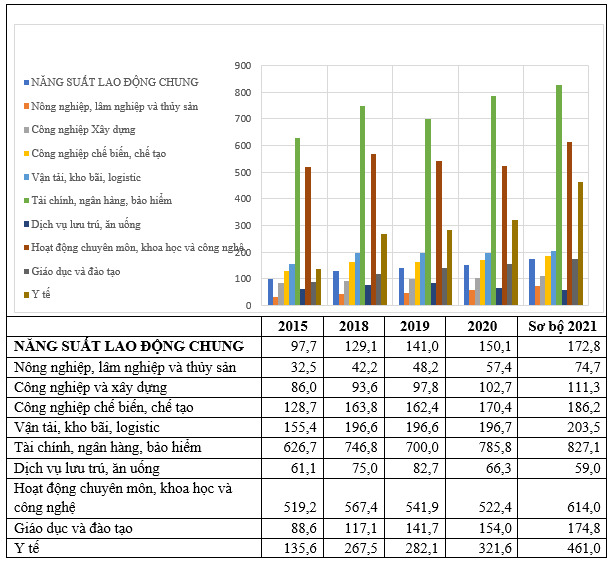

In particular, there is a big difference in labor productivity between industry groups, in which the finance and banking industry together with the professional, scientific and technological sectors have the highest labor productivity, banking and finance sectors have the highest labor productivity while healthcare income has improved in the recent years (Figure 8). Meanwhile, traditional industries listed as agriculture, forestry and fisheries have low labor productivity. It is worth noting that the processing-manufacturing industry has always led in terms of growth; nevertheless, labor productivity is not commensurate.

Figure 8. Labor productivity by industry (Million VND). Source: Statistical Yearbook (2021)

Author Team: Dr. Dinh Cong Khai, Dr. Nguyen Van Du, Dr. Nguyen Le Hoang Thuy To Quyen, Faculty of Government, UEH College of Economics, Law and Government

This is an article in the series of articles spreading research and applied knowledge from UEH with the message “Research Contribution For All – Nghiên Cứu Vì Cộng Đồng”, UEH cordially invites readers to look forward to the upcoming Knowledge Newsletter ECONOMY #73.

News, photos: Author Team, UEH Department of Marketing and Communication

Voice of: Ngọc Quí